If you’re like many people, you may have a stack of old tax returns taking up space in your home or office. Knowing how to handle these documents can be crucial for protecting your personal information and maintaining compliance with tax regulations. Here’s a guide on what to do with your old tax returns and the best practices for managing your financial documents.

Consult a Professional

Before making any decisions about your tax returns, it’s wise to consult with a professional accountant. An experienced accountant can provide tailored advice on which documents you need to retain for filing your taxes each year and how long you should keep them after filing. This consultation can help you understand the complexities of tax documentation and ensure that you’re compliant with the latest regulations.

Keep Essential Documentation

After filing your taxes, it’s essential to keep a copy of your tax return along with all supporting documents. These may include:

- Forms 1099 and W-2: These forms report your income and are critical for your tax records.

- Expense Tracking: Receipts, expense reports, and mileage logs are vital for substantiating any itemized deductions you claim.

- Supporting Records: Any documents that verify the numbers on your tax return should be kept as well.

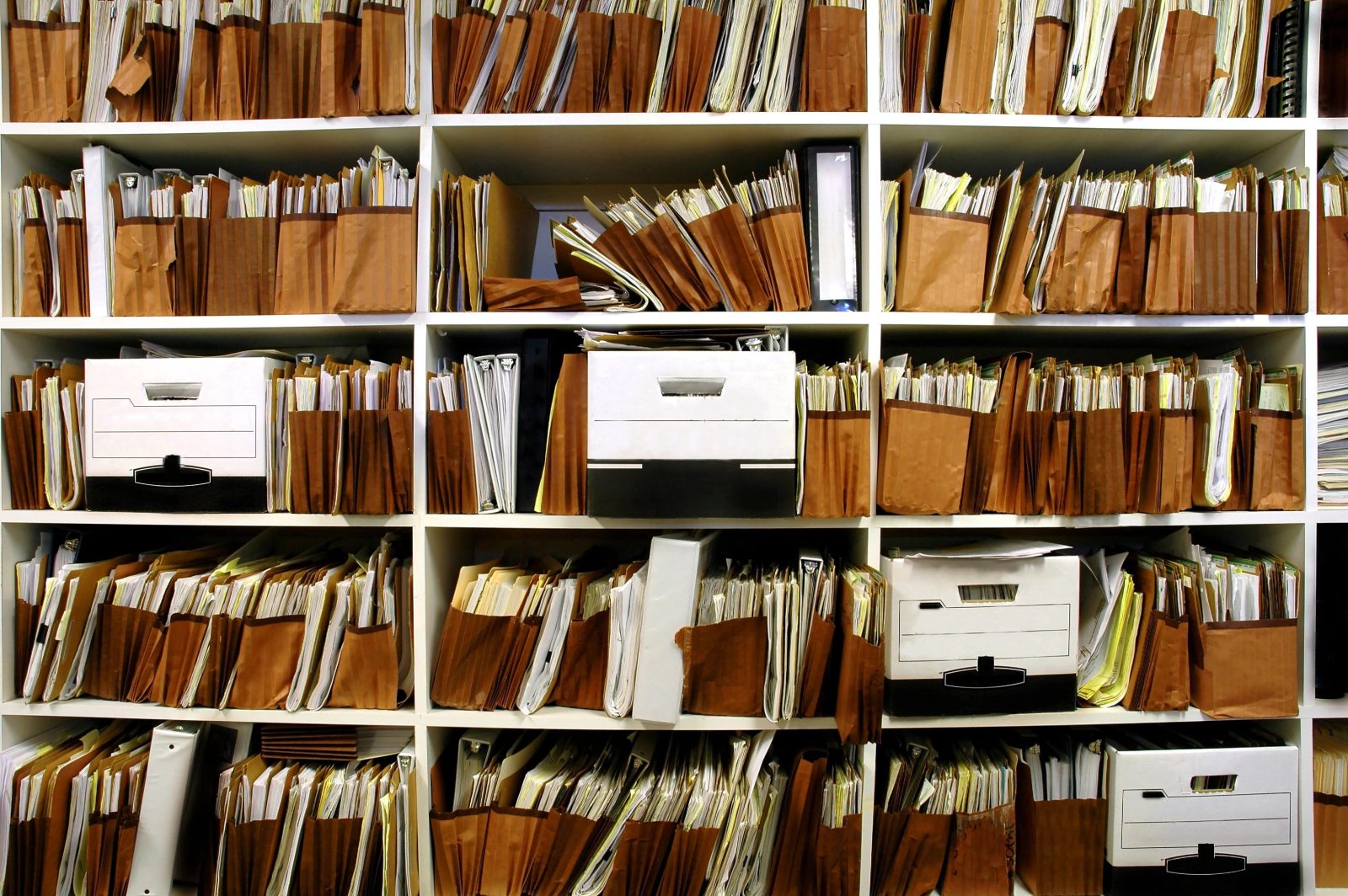

For businesses, the documentation requirements extend further. You should also retain:

- Bank Statements: To track your financial transactions.

- Payroll Records: Important for employee compensation and tax withholding.

- Other Business Documents: Such as invoices and expense receipts.

General Retention Guidelines

As a general rule of thumb, the IRS recommends keeping tax records for at least seven years from the date you filed your return. However, there are exceptions that could necessitate keeping documents for longer periods. For example, if you underreport your income by more than 25%, the IRS may extend this period to six years. If you’ve filed a claim for a loss from worthless securities, you may need to keep those records for up to seven years. To delve deeper into these guidelines, visit the IRS website for detailed information on tax document retention rules.

Safeguard Your Sensitive Information

Tax records contain sensitive personal information, including Social Security numbers, financial data, and details that could be exploited for identity theft. Therefore, it is crucial to dispose of these documents securely. Rather than simply throwing them away, which poses a risk of exposure, consider using a certified shredding service.

Choose a Certified Shredding Company

A NAID member shredding company, like SecureShred, can ensure that your old tax documents are destroyed in a safe and secure manner. We offer services to pick up and shred your outdated tax files once they reach the required retention period. By using a professional shredding service, you not only protect your sensitive information but also comply with legal requirements for document disposal.

Conclusion

Effectively managing your old tax returns is essential for protecting your personal information and complying with IRS regulations. By consulting with a professional, keeping the necessary documentation, and securely shredding outdated records, you can ensure that you’re safeguarding your identity while maintaining a clutter-free environment. Take the proactive steps necessary to handle your tax documents responsibly, and consider partnering with a certified shredding service to streamline the process. Your future self will thank you!