In the past, the question of “how long should I keep these records?” often had a straightforward answer: keep everything indefinitely. However, as privacy regulations have become more stringent and penalties for noncompliance more severe, organizations are now scrutinizing the disposition of records as a critical part of the information lifecycle.

Understanding Disposition

In the realm of records management, particularly under the Generally Accepted Recordkeeping Principles (GARP), “disposition” refers to the process by which records that are no longer required by law or company policy are disposed of in a secure and appropriate manner. This means that once a record has been retained for the necessary period, it should be disposed of according to your organization’s established policies.

Disposition is often associated with destruction, especially in the case of physical documents or the deletion of electronic records. However, there are exceptions. For example, if a record holds historical significance, it should be preserved rather than destroyed. Additionally, if your organization is involved in a merger or acquisition, records may need to be retained for sale rather than disposed of.

How Long Should Records Be Retained?

Determining how long to keep records is crucial for proper disposal. Unfortunately, many organizations struggle with this issue. Understanding the types of records you possess, their formats, and where they are stored will help you establish retention timelines.

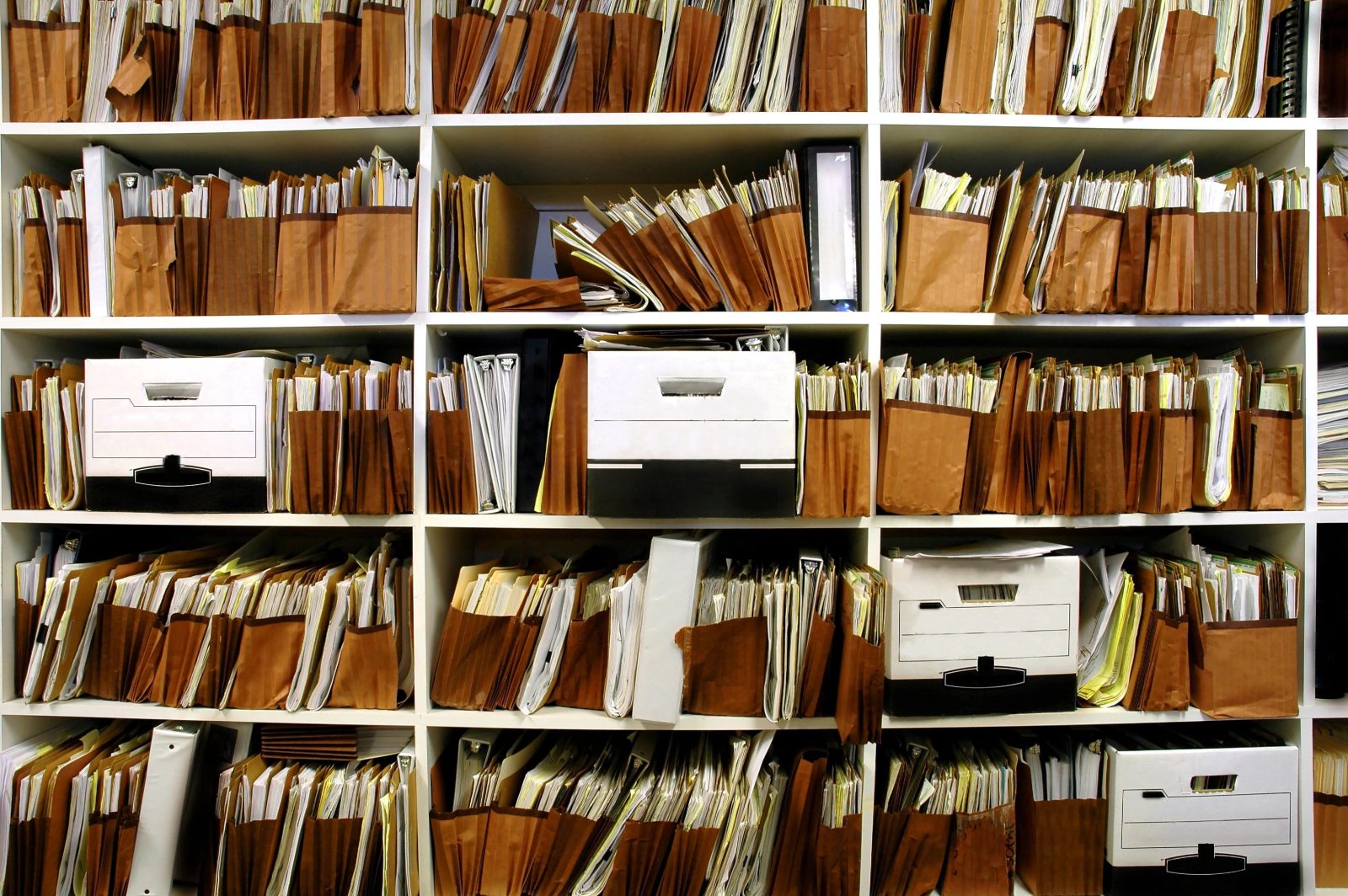

The first step in this process is to conduct a thorough audit. As organizations assess their records, various factors can complicate the process, including:

- Duration of Operation: The longer an organization has been in business, the more records it will have to manage.

- Geographic Distribution: Multiple locations can create variations in how records are stored and managed.

- Storage Locations: Records may be stored on-site, off-site, or in a combination of both, impacting accessibility and management.

- Record Systems: The number of different systems used to maintain records, along with the formats they are in, adds complexity to record-keeping efforts.

Creating a Simple Records Retention Schedule

During the audit, it’s essential to ensure that records have appropriate metadata attached. A records retention schedule should address several key elements:

- Responsibility: Who is responsible for maintaining the retention schedule?

- Record Details: What specific data are being recorded?

- Retention Duration: How long does each record need to be retained?

- Storage Location: Where are the records stored?

Engage with knowledgeable personnel within your organization who understand where records are kept and the significance of each document. As you review your inventory, you will be better equipped to ask insightful questions and receive accurate answers regarding the importance of various documents.

As your retention schedule and inventory evolve, they will create a cascading effect that leads to a more comprehensive inventory and a reliable records retention strategy.

Documenting Disposition Policies and Procedures

Once you have developed a thorough records retention plan, it’s vital to document your disposition policies and procedures. This involves creating a detailed outline of how specific types of records will be managed when it comes time for destruction. Although this may seem repetitive, it’s important to remember that the procedure is separate from the retention schedule; the procedure outlines how to carry out the disposition systematically.

This documentation serves as a safeguard against risks posed by audits, legal challenges, and other scrutiny. Collaborating with your organization’s management and legal counsel can help ensure that all necessary aspects are covered.

Additional Tips for Record Retention and Disposal

- Justify Retention: If you decide to keep a record, make sure you have a clear reason for doing so. Understand the privacy regulations applicable to your industry, as they may influence your retention policies. If there are currently no laws governing your records, it’s likely that they will be implemented in the future.

- Follow the Plan: Adhere to your established retention and disposition policies. Avoid inconsistent or excessive disposal, especially when responding to audit requests or legal inquiries. Inconsistencies can damage your organization’s credibility and force you to justify deviations from your plan.

In conclusion, navigating records retention and disposition is essential for compliance, security, and operational efficiency. By implementing a robust records management strategy, you not only protect sensitive information but also position your organization for long-term success in an increasingly regulated environment.