In today’s fast-paced business environment, having a robust records management system is essential for accounting firms. Such a system not only organizes documents but also includes a well-defined retention schedule that helps safeguard sensitive client information. Failing to manage records effectively can expose your business and clients to significant risks, including identity theft. By implementing a structured retention schedule and ensuring proper storage and disposal methods, you can significantly mitigate these risks.

The Importance of a Document Retention Schedule

Every accounting firm should have a clear document retention policy in place. This policy outlines how long various types of documents should be kept and when they should be securely disposed of. Retaining documents beyond their necessary lifespan can lead to unnecessary exposure of confidential information, putting both your firm and your clients at risk. A well-maintained retention schedule helps ensure that sensitive data is disposed of securely when it is no longer needed.

When the retention period for a document expires, it’s crucial to transfer those documents to a secure location. For example, you can place them in a locked box designated for shredding. This is where services like SecureShred come into play. We not only provide secure pickup for your documents but also ensure that they are destroyed safely. Upon completion, you will receive a certificate of destruction, giving you peace of mind regarding your compliance and security practices.

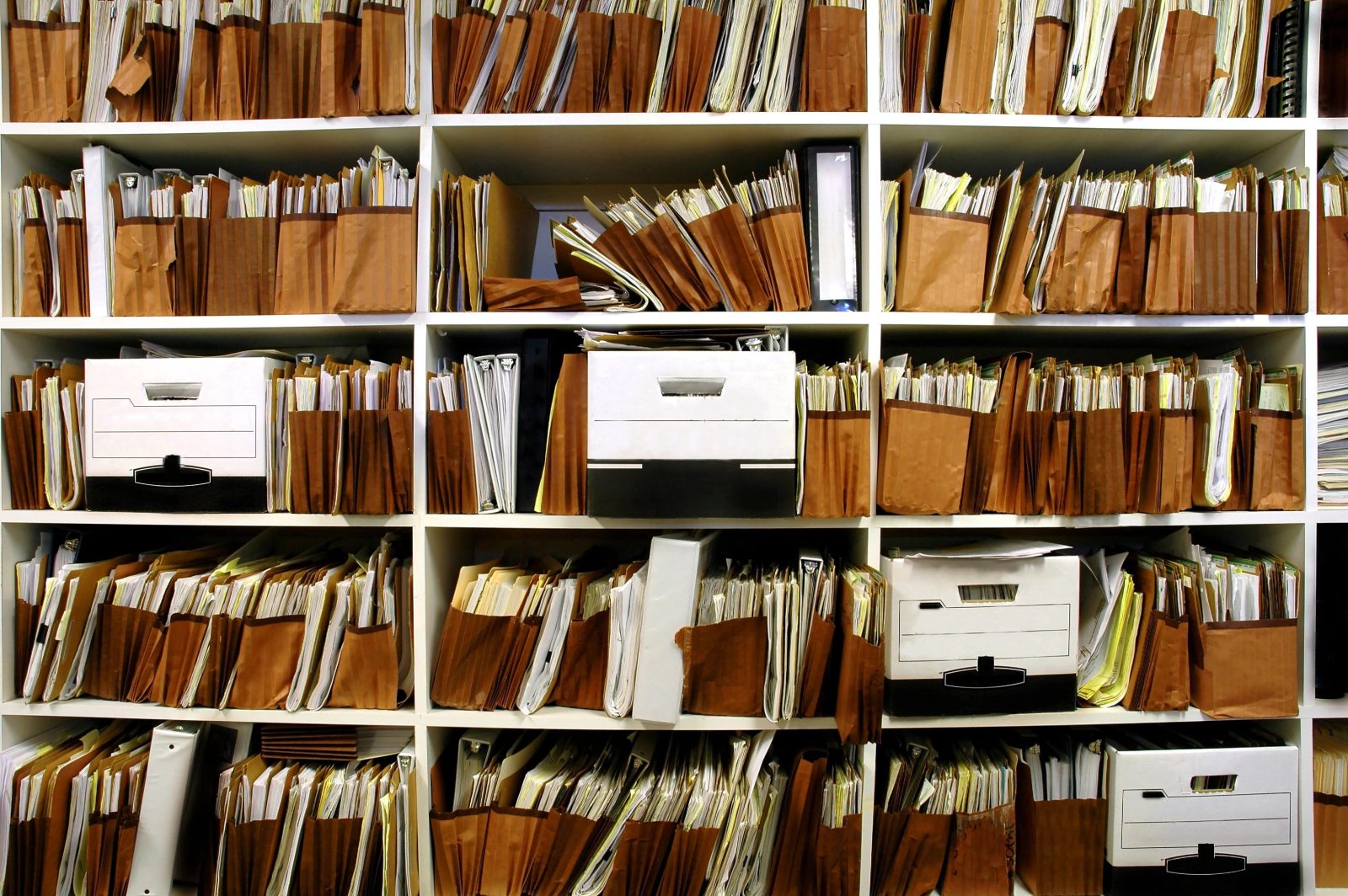

Effective Records Administration

A comprehensive records management system streamlines the process of locating and retrieving documents. With an organized system in place, you can access files almost instantly, whether for in-house purposes or client requests. If you digitize your documents, the retrieval process becomes even simpler. Scanning and organizing documents electronically can save significant time and effort, allowing for more efficient workflow.

Organizing Paper Documents

For physical documents, it’s essential to label each one with its retention date. Once a document surpasses this date, it should be moved from your filing system into a lockable shred box. This practice not only declutters your filing cabinets but also frees up valuable space for new client files. Additionally, it reduces the risk of unauthorized access to sensitive information. If your documents are stored at a Records Storage facility, you can have them shredded once they reach the end of their designated retention period.

Streamlining Electronic Filing

When it comes to electronic records, it’s essential to implement a filing system that is both intuitive and organized. Start by organizing files under the client’s name, then categorize them by year, quarter, or month. This method simplifies the process of locating specific documents when requested. Moreover, it allows you to easily identify and eliminate files that are no longer necessary, keeping your digital storage organized and efficient.

Understanding Retention Timeframes

The retention period for each document can vary based on several factors, including industry regulations, state laws, and the nature of the document itself. If you are dealing with business clients, their specific industry standards may dictate the appropriate retention duration. It’s vital to stay informed about these requirements to ensure compliance.

Building an Effective Records Management System

Creating a successful records management system involves more than just having a reliable method for scanning and storing documents. You also need a secure process for disposing of documents once their retention period has expired. Engaging a professional shredding service can save your firm valuable time and ensure that materials are shredded according to a predetermined schedule. A carefully crafted records retention plan will help safeguard expired documents before they are shredded.

SecureShred offers locked shred boxes that are collected on a scheduled basis. Simply deposit documents through the slot in the locked box, and we will empty these boxes at the designated times. For larger purge projects, we can arrange bulk pickups, ensuring that all documents are collected and shredded securely. After shredding, the materials are baled and sent to a certified recycling facility, promoting eco-friendly practices.

In conclusion, establishing a secure and effective records management system is essential for any accounting firm. By prioritizing document retention and destruction, you can protect sensitive information, streamline your operations, and enhance overall client trust.